Recognizing the Value of Financial Offshore Accounts for Service Growth

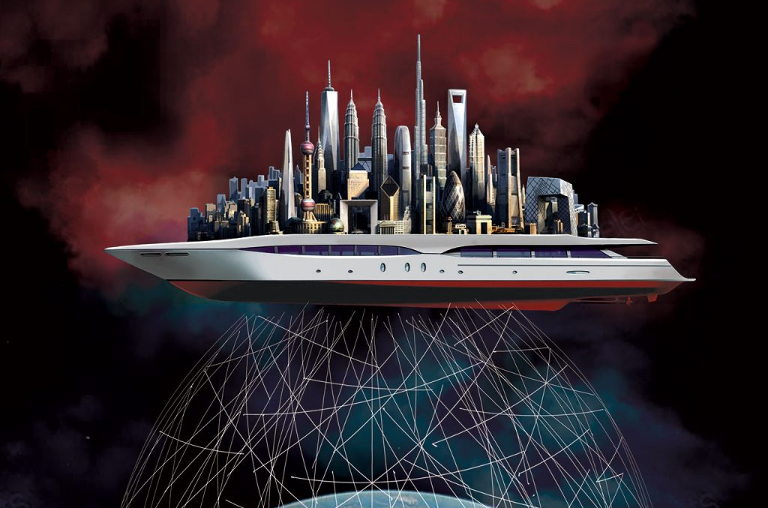

In the dynamic globe of global commerce, monetary overseas accounts stand as crucial devices for company development, supplying not only improved currency flexibility but additionally possible decreases in transaction costs. This complexity invites further expedition into exactly how services can successfully harness the benefits of overseas financial to drive their development initiatives.

Trick Advantages of Offshore Financial Accounts for Services

While several companies seek competitive advantages, using overseas financial accounts can provide substantial benefits. These accounts are crucial in helping with international trade by enabling business to manage several currencies more effectively. This capacity not only streamlines deals but can likewise minimize the deal costs that accumulate when dealing with worldwide exchanges. Furthermore, overseas accounts typically supply better rates of interest contrasted to residential banks, improving the possibility for earnings on idle funds.

Furthermore, geographical diversification inherent in offshore banking can act as a threat administration device. By spreading out assets across various territories, businesses can safeguard against local financial instability and political dangers. This method makes certain that the firm's resources is shielded in differing market conditions. Finally, the privacy supplied by some overseas jurisdictions is a critical aspect for services that prioritize confidentiality, especially when dealing with delicate deals or exploring brand-new endeavors.

Lawful Factors To Consider and Compliance in Offshore Banking

Although overseas financial accounts supply various advantages for companies, it is important to recognize the legal structures and compliance demands that govern their use. Each territory has its own set of regulations and guidelines that can significantly affect the performance and legality of offshore financial activities. financial offshore. Services should guarantee they are not just complying with the legislations of the nation in which the offshore account lies however additionally with global financial guidelines and the regulations of their home country

Non-compliance can result in serious lawful effects, including penalties and criminal fees. It is essential for Visit Website services to involve with lawful experts who focus on worldwide financing and tax legislation to browse these intricate lawful landscapes effectively. This guidance aids guarantee that their offshore banking activities are carried out lawfully and fairly, straightening with both international and national requirements, therefore protecting the business's online reputation and financial health.

Strategies for Integrating Offshore Accounts Into Business Procedures

Incorporating offshore accounts right into business operations calls for mindful preparation and critical implementation. Firms have to initially establish a clear goal for using official statement such accounts, whether for capital preservation, tax optimization, or international expansion. It is vital to select the appropriate territory, which not only straightens with business objectives however also offers political and financial security. Lawful advice ought to be involved from the start to navigate the complex regulative frameworks and make certain compliance with both home and foreign tax obligation legislations.

Organizations i loved this ought to incorporate their overseas accounts into their total financial systems with openness to maintain depend on among stakeholders (financial offshore). This includes setting up durable audit techniques to report the circulation and track of funds properly. Regular audits and evaluations must be performed to reduce any dangers connected with offshore banking, such as fraudulence or reputational damage. By methodically executing these techniques, companies can properly make use of overseas accounts to support their development campaigns while sticking to lawful and moral requirements.

Verdict

In verdict, overseas monetary accounts are important assets for organizations intending to expand globally. Integrating them into service operations strategically can dramatically enhance cash flow and align with more comprehensive company development goals.

In the dynamic globe of international commerce, monetary overseas accounts stand as crucial tools for company development, supplying not just enhanced currency flexibility but additionally possible reductions in transaction prices.While lots of services seek competitive benefits, the use of overseas economic accounts can offer significant advantages.Although overseas monetary accounts offer various benefits for organizations, it is important to understand the lawful frameworks and conformity demands that regulate their usage. Companies must guarantee they are not only complying with the regulations of the country in which the overseas account is located but additionally with worldwide economic guidelines and the laws of their home country.

Comments on “How Financial Offshore Options Provide Privacy and Financial Privacy”